Answering the Five Questions You Should Be Asking About HB1

On Jan 23, 2023, Edu-blogger Peter Greene published an article at forbes.com entitled “Is Your State Considering An Education Savings Account Voucher Law? Here Are Five Questions You Should Be Asking.” Florida’s recently filed HB1 will create Universal Education Savings Accounts when passed (and with a supermajority in both chambers, it will definitely pass). This blog will answer the questions Greene asks.

Greene explains “Education Savings Accounts are the newest version of school vouchers. They provide parents with a chunk of money to spend on any number of education-related expenses, from books to transportation to computer software. In some cases, ESA bills represent a shift of billions of dollars of taxpayer money from public schools to private ‘education service providers.'”

These are the five questions you should be asking about HB1:

1. Who is eligible to receive the voucher?

As Green writes “Some states have gone with a voucher “starter” bill which limits eligibility to students below a certain income line or students with special needs. There may be a requirement that students are leaving the public school system, but increasingly states are aiming for a universal voucher that has no income requirements and can be used for students who are already enrolled in private schools. The more students who are eligible, the more expensive the bill will be for taxpayers.”

ANSWER: Everyone. Florida is well past “starter bills.” Florida has been slowly expanding vouchers for both low income students and students with special needs for 2 decades. Since 2014, Florida has had an ESA program for students with special needs. HB1 converts ALL vouchers to ESAs AND eliminates essentially all eligibility requirements, making any student who is a resident of Florida and is eligible to enroll in kindergarten through grade 12 in any Florida school eligible for an ESA, whether or not they ever actually attend a school at all.

HB1 converts what was a school choice voucher for at risk students into a publicly funded giveaway available even to the uberwealthy, who can receive state funded tuition rebates for their exclusive private schools – schools which will have NO obligation to admit low income children or provide special education services to those in need. When a family accepts a Florida voucher, they agree to leave the public school system and forgo any rights, provided by the federal Individuals With Disabilities Education Act (IDEA), to a free and appropriate public education, including services for their child’s special needs. To be clear, private schools are under no obligation to provide services to special needs children, nor are they required to accept voucher recipients. By converting Florida’s vouchers to ESAs, wealthy families can be reimbursed, with public funds, for a portion of their private school tuition WITHOUT the school having to “participate” in any voucher programs. The elite private schools will remain out of reach for the vast majority of Florida’s children, especially those in the most need.

2. How are the vouchers funded?

Greene writes: “The state must get the money from somewhere. Typically there are two preferred options; either from the funding for the district where the voucher student lives, or from the general education funding pool for the state. In the former, the impact is felt primarily by the local school district and its taxpayers, but in the latter, school districts that don’t even include voucher students lose state funding.

This funding loss is especially acute in states that allow vouchers for students who were never in public school to begin with. In that situation, local school districts lose funding while their operational costs remain exactly the same. School districts must either cut programs or increase the burden on local taxpayers.”

ANSWER: Florida does both. Florida’s Tax Credit Scholarship/Voucher programs is funded through tax credits for corporations that contribute money to nonprofit Scholarship-Funding Organizations (SFOs), mostly from beverage companies who redirect their alcoholic beverage excise tax by donating it to Step Up For Students (SUFS), Florida’s largest and most politically connected SFO. Florida’s Family Empowerment Scholarships are funded through the Florida Education Finance Program (FEFP), where the state claws back funding for the FES vouchers, directly from the districts (see page 7 of the 2022-23 FEFP – Second Calculation to see how the state clawed back $1.3 Billion from districts, ~13% of the Net State FEFP).

As of 2021, students have no longer needed prior public school attendance to be eligible for a voucher in Florida. This forces districts to guess how many private school students might need funding in their upcoming budget and, as Greene noted, when the funding is clawed back for students who have never enrolled in district schools, district operational costs remain exactly the same yet funding has been diverted to private schools. When HB1 passes, homeschool families will also be eligible for public funding. Currently, Florida has over 100,000 registered homeschoolers. Eventually, full funding of current homeschool families could cost the state (districts?) an additional $1 BILLION+ annually. Article IX of the Florida Constitution says it is a “paramount duty of the state to make adequate provision… for a uniform, efficient, safe, secure, and high quality system of free public schools.” What will be the cost to expand that responsibility to all private and homeschooled children? According to HB1, the cost is “indeterminent.”

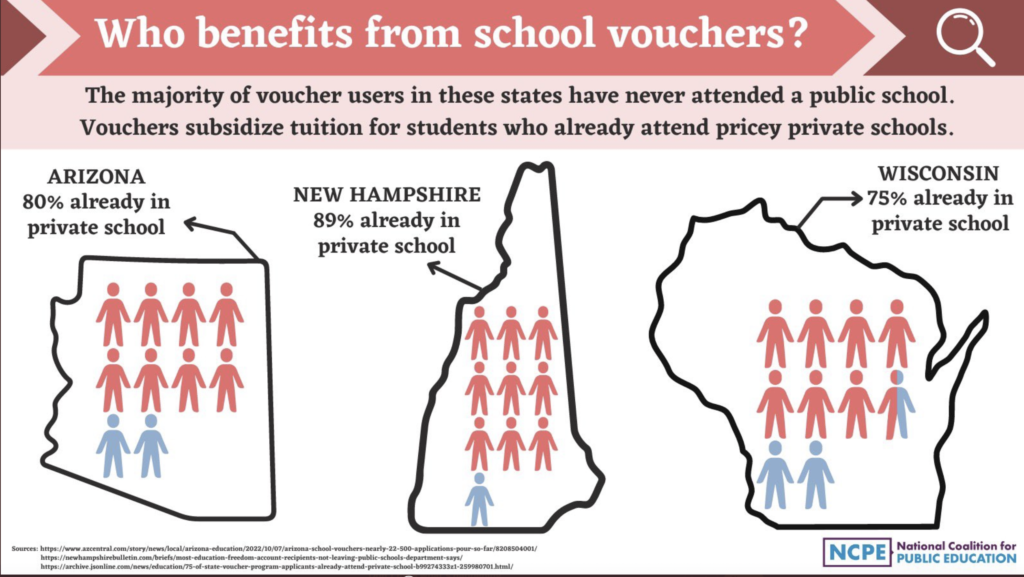

Actually, other states who have moved to Universal Vouchers have seen 80% of vouchers go to students who are already attending private school or homeschooling and, in virtually each case, the predicted costs were vastly underestimated when those bills were pushed through their legislatures. In 2021, researchers at the National Education Policy Center extrapolated the cost of instituting Universal Vouchers and estimated the total public costs of education would increase by between 11% and 33% with universal vouchers, depending upon both the exact design of the policy and the behavioral responses. This school year (22/23), Florida Total k-12 spending is $24.2 Billion. 33% of 24.2 Billion is $8 Billion of increased spending.

3. How is the program administered?

Greene writes: “In many cases, the bill instructs the state to hire a management company to operate and administer the voucher program. This company will be responsible for setting criteria for service providers and determining which expenses may or may not be allowed. In effect, the state outsources responsibilities of its education department to a private company (an issue being tested in a New Hampshire lawsuit).”

ANSWER: Florida already uses private, “not-for-profit” Scholarship Funding Organizations to operate and oversea its voucher programs, the largest of which is Step Up for Students (there is a second SFO, AAA, who serves a much smaller number of families). Current ESA recipients (those who participated in the Gardiner ESA program for children with special needs) have complained that SUFS’s management system is incapable of handling the currently enrolled ESA recipients and they are concerned about further disfunction with this massive expansion to Universal ESAs. The current system for the special needs ESAs is already overwhelmed – what will happen when several hundred thousand more students enter this already inadequate system? These families have asked the legislature to insist on oversight of the scholarship funding organizations with little success. As a private company, SUFS will be funneling $BILLIONS of public funds through their marketplace, with little oversight and little to no public transparency.

4. What protections are in place for students and families?

Greene writes: “Under most voucher programs, students with special needs waive their rights. Parents are asked to sign off on a statement that they are now fully responsible for their child’s education. Most bills include no requirement for gatekeeping for vendors; if you want to be eligible to collect voucher dollars, just fill out a form. Voucher programs, so far, do not include any recourse for parents who find they have been defrauded by service providers or who find that the voucher dollars do not go far enough. No voucher program, existing or proposed, makes any promises about maintaining the dollar amount of the voucher.

Often service providers’ rights are more explicitly protected than those of students. Taking voucher money does not make them “an agent of the state or federal government.” They will be given “maximum freedom.” Typically a provider shall not be required “to alter its creed, practices, admissions policy, or curriculum.” They remain free to discriminate as they wish.”

ANSWER: The ultimate goal of ESAs is not simply to privatize public education but to privatize the responsibility for education. HB1 makes this very clear. Families who choose to homeschool with their ESA must first affirm that they are responsible for their child’s education. There are no academic requirements – educational options are to be based on the individual child’s needs. Should they learn Science? That would be nice, but not required. Families must waive their civil rights and federal IDEA rights when the accept the voucher/ESA. Most of the guardrails are placed on the parents, to ensure they don’t spend the money inappropriately.

5. What accountability and oversight measures are in place?

Greene writes: “Does the bill include any calls for regular or random audits? Do service providers have to submit any measures of effectiveness? Or do taxpayer dollars simply disappear into a black hole, with no public accounting of financial or educational results?”

ANSWER: In Florida, Scholarship Funding Organization (SFO) must submit a financial and compliance audit performed by an independent CPA each year. There is also a requirement that the Auditor General annually conduct an operational audit of the accounts and records of SFOs. Voucher recipients are supposed to take a standardized assessment annually, and private schools with significant voucher populations must submit the scores to Learning Systems Institute at Florida State University, which calculates learning gains and publishes a report. Here is the June 2020 report. Although many of the voucher schools have negative learning gains, the scores are not used to grade schools, evaluate teachers, retain students or for graduation requirements. Public schools, of course, are required to take state mandated assessments which can be used to label schools as failing, label teachers as ineffective and label young students as “deficient.”

As for the individual purchases, HB1 allows the ESA funding to be used for, in addition to or in lieu of, private school tuition, instructional materials, including digital devices and internet access, part-time tutoring, standardized assessments and curriculum. Private schools need not be accredited. Neither private school teachers nor part-time tutor require certification. As for digital devices, current ESA recipients (FES-UA) may use their public education dollars to purchase a laptop, desktop, phone, tablet, game console, smart watch, VR, AND MP3 player every two years plus 1 day.

HB1 does require scholarship funding organizations to develop purchasing guidelines for authorized uses of scholarship funds and publish them to their websites. The bill also requires that ESA recipients who plan to homeschool to work with “choice navigators,” who will assist parents in accessing various educational options and report their child’s test scores to FSU’s Learning Institute. There is no mention of what qualifications these “choice navigators” will have or how they will be paid.

I believe there are more questions that should be asked. Like, “is this even good for children?”

- Vouchers are incredibly expensive and primarily benefit students who have never attended a public school.

- Vouchers subsidize tuition for student who already attend pricey private schools.

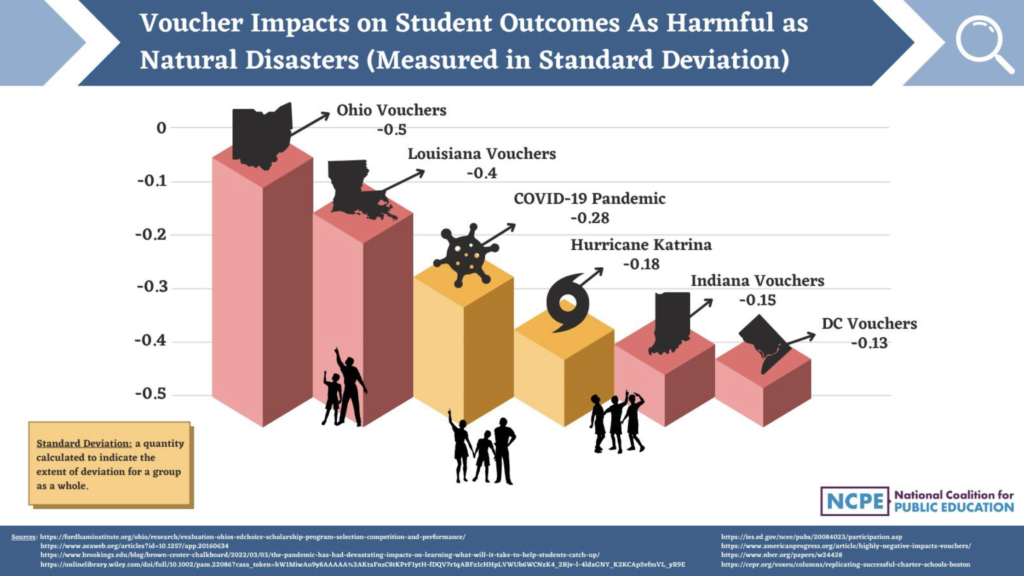

- In study after study, voucher programs have been shown to severely hinder academic growth — especially for vulnerable kids. The losses seen in the Louisiana and Ohio Voucher studies EXCEED the losses seen following Hurricane Katrina and Covid.

- Why must low income children leave their neighborhoods in order to receive a quality education? If we have enough money to subsidize rich people’s elite private school tuition, why can’t we provide the resources low income students need to have high quality schools in their own neighborhood?

Clear and concise information that can be trusted. Retrograde step in education.

This is a disaster for public school education and democracy.

How will HB1 affect students that already receive SUFS? Are they able to apply for both?

This is an expansion of the Family Empowerment Scholarship. The FES-EO and FTC were also transformed into Education Savings accounts. The FES-UA was left essentially unchanged with the exception that the enrollment cap expands more rapidly now. SUFS is a scholarship funding organization that administers many different voucher programs.