Should Monroe Tax Dollars Be Used to Open Charter Schools in Escambia? More Fiscal Shenanigans in Florida.

Last week, the Florida GOP super majority advanced bills which will require the distribution of school district capital outlay funds to charter schools on a per pupil basis, regardless of demonstrated need (HB1259/SB1328). This week they approved an amendment allowing corporate charter chains to share (technically it’s a 5-year loan) any unneeded revenue with charters in the same corporate network but in an entirely different county.

The amendment’s sponsor says her amendment is simply an expansion of current statute (f.s. 1002.33(17)) which currently allows charter chains to share funds between their schools within the same district. The question is: should taxpayers in Monroe be funding the expansion of corporate charter schools in Escambia?

The amendment, filed to SB986 during the 4/25/23 Senate Fiscal Policy committee meeting, was proposed by freshman senator, Alexis Calatayud, who admitted the purpose was to help these charter chain corporations expand throughout the state. The only public commenter (who waived in support) was a lobbyist for Academica. A lobbyist for Charter School Leaders of Florida was also present to support the bill (SB986) once amended. [Academica and Charter Schools USA are two of the largest corporate charter chains in Florida and (fun fact) both made significant contributions to Calatayud’s 2022 campaign.]

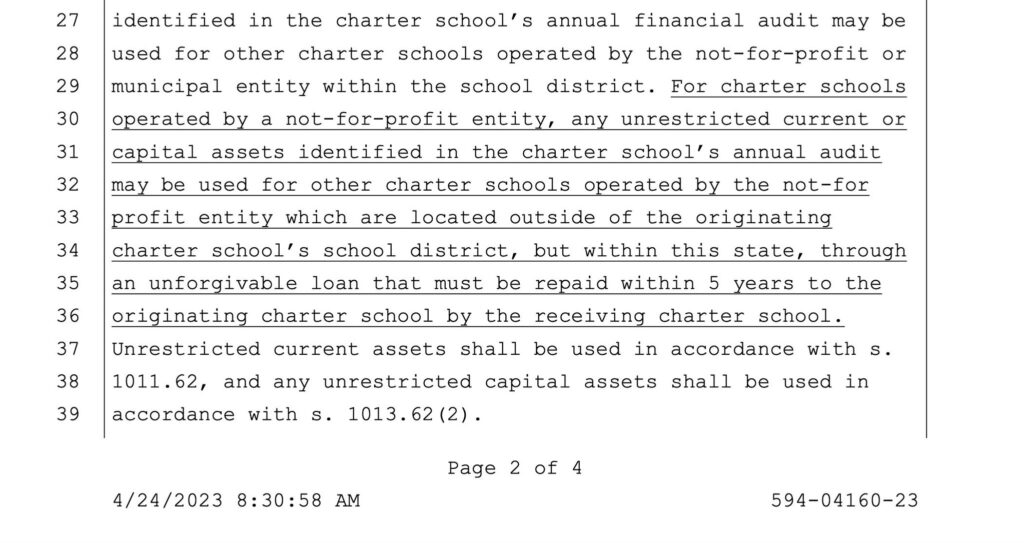

This is the amendment:

How does this reconcile with “the money should follow the child” when the money is literally being used to support a school in another county?

When Sen. Calatayud presented her amendment, she was very disciplined in her responses to questions from colleague Shevrin Jones, being sure to repeat this applied to “not for profit” charters, the “unrestricted current or capital assets” would be identified by a year-end audit and this was simply allowing an unforgivable loan which would be repaid within 5 years. (You can watch her presentation here at 48:59). Of course, Sen. Calatayud knows full well that Florida’s for-profit charter school chains (like Academica and Charter Schools USA) are required, by law, to have non-profit schools but are run by very lucrative for-profit Charter School Management Companies, which have been able to amass fortunes, especially in real estate holdings, funded by public tax dollars.

When Sen Jones asks Calatayud if her amendment would allow local millage funds to be loaned to a school in another county, Calatayud claims “This would not allow any local funding to be moved.” She claims the amendment “explicitly” refers only to “state funds from prior years within a category called ‘unrestricted funds.’” This is categorically false. There is no restriction in the amendment or the amended statute restricting the loans to only state funds.

Perhaps Calatayud doesn’t fully understand the state funding formula, the Florida Education Finance Program, or FEFP, which provides the per pupil funding to district managed and charter schools. Approximately 45% of the total FEFP funding is funded by LOCAL tax dollars, through the “Required Local Effort” or RLE. The amount of funds any single district is required to raise to fund the formula varies by district, with property rich districts contributing a greater percentage of their FEFP than less wealthy districts. In property rich districts like Monroe, the state funds just 10% of their FEFP funding, with local tax payers contributing the other 90%.

Also, since her amendment allows for the loaning of capital assets, buses, furniture or other tangible assets, purchased with local capital millages, could be shared with schools in other counties.

A few definitions:

- Current Assets include cash or other assets that are reasonably expected to be realized in cash or sold or consumed within a year. (This would include unused FEFP per pupil spending)

- Capital Assets include land, buildings, vehicles, furniture, equipment and all other tangible and intangible assets that are used in operations and have useful lives that extend beyond a single accounting period. (these are items that are generally purchased using capital outlay, including shared millages)

When Jones asked if there were any accountability measures for the use of these funds in other districts, Calatayud responded “The movement of unrestricted funds is currently in statute, so we would utilize the same process.” Read f.s.1002.33(17). There is no mention of accountability or reporting measures for these funds.

Calatayud was able to convince her democratic colleague, Sen. Rosalind Osgood that this was a great way to fund new charter schools. Really? Couldn’t these funds be better spent on the students in their home district?

Calatayud’s amendment (now SB986) will work hand in hand with SB1328 to allow local tax dollars to be used to expand corporate charter chains around the state. SB1328 will allow local capital outlay funds to go to charter schools without regard to need. SB986 will allow unneeded funds to be spent around the state, expanding corporate charter chains in distant counties.

Of course, Calatayud’s amendment to SB986 defies two of the Florida GOP’s school choice talking points:

- The money does NOT follow the child and

- the amended bill funds systems, not students.

Calatayud will be forgiven, however, since she has found a way to pool local tax dollars, once intended for local public schools, and expand corporate charter schools across the state – defunding public schools while simultaneously expanding private options is clearly Tallahassee’s Prime Directive these days.

One Comment