Intellectually Bankrupt: Education Funding in Florida and the Impacts of HB1/SB202

The Florida Policy Institute (FPI) is an independent, non-partisan, and non-profit organization dedicated to advancing policies and budgets that improve the economic mobility and quality of life for all Floridians. Per their website, they “do this through research, strategic outreach, coalition building, and policy advocacy.” Recently, they have been taking a look at the costs associated with Florida’s private school voucher programs.

In September 2022, they released “Florida’s Hidden Voucher Expansion: Over $1 Billion From Public Schools To Fund Private Education,” finding:

- In 2022-23, an estimated $1.3 billion in funding will be redirected from public school districts to private education, representing 10% of state K-12 education funds allocated through the Florida Education Finance Program (FEFP), the state’s school funding formula;

- This sum is in addition to a potential $1.1 billion taken from general revenue that would otherwise be used to support state services, including education, as a result of tax credits claimed by businesses that donate to voucher programs;

- Deductions to local school districts’ budgets to account for students receiving vouchers occur after annual school budgets have been finalized. This poor timing is even more challenging because of mid-year increases in voucher costs and district fixed costs;

- The impact of vouchers on districts’ budgets ranges up to 9% of the total FEFP budget (state and local dollars) as of the start of the 2022-23 school year.

In February, they published “Florida SB 202 (2023): Potential Fiscal Impacts, finding “Even under conservative estimates, Florida Empowerment Scholarship (FES) vouchers would cost the state about $4 billion in the initial year of SB 202 implementation.“

The $4 billion price tag was questioned after FPI’s Senior Policy Analyst, Norin Dollard, PhD, testified before multiple legislative committee meetings regarding FPI’s concerns regarding the impact of HB1 and SB202 on public education funding. FPI published a follow-up report, “The Cost of Universal Vouchers: Three Factors to Consider in Analyzing Fiscal Impacts of CS/HB 1,” highlighting the differences between their $4 billion estimate and HB1’s $209 million fiscal impact statement.

When Dr. Dollard presented FPI’s concerns during the 3/10/23 House Education Quality Subcommittee meeting (watch at 44:30), Brevard Rep. Randy Fine questioned the FPI’s $4 billion dollar estimate because it included funding for students already funded by voucher and/or the FEFP (his questions start at 47:15). He argued Dr. Dollard’s calculations were “intellectually bankrupt” because they estimated the costs of Florida’s entire voucher program, not just HB1’s impact.

Fine was right about one thing. The FPI’s calculations did include all of the costs to taxpayers and public schools following HB1’s implementation. Those costs are massive. Underestimating those costs, as happened in Arizona and New Hampshire, is politically expedient.

Fine and his colleagues, like the legislators in Arizona and New Hampshire, need to hide the impact of the total cost of the ever expanding voucher program because they knows it is fiscally irresponsible to fund two separate systems of schools and it defies fiscal conservatism to do so without considering the overall impact of such policies have on the public education system of schools, which currently are relied on by 2.9 million of Florida’s children. Fine shows clear disdain for public schools, repeatedly and intentionally referring to them by the slur “government schools,” but he also knows public schools are tremendously popular with Florida families and therefore it is more popular to hide the fact you are deliberately defunding them rather than admit you are doing so.

Fine and his colleagues are failing to address the real potential costs of HB1 (and refusing to add any guardrails to prevent those impacts) and vastly underestimating the costs of this voucher expansion. We know, from past experience, public schools will mostly likely bear the brunt of their budgeting error.

Briefly, here is the financial jujitsu that results in the ridiculously low fiscal impact predicted for HB1 (details follow).

- Assumes current non-participating private schools will not start participating in FES once tuition rebate is offered to all of its families. There are currently almost 200,000 privately paying private school students. The fiscal ignores 83,000 of these students. ($664 million)

- The fiscal assumes that only 53% of families in currently participating schools will participate in the free tuition rebate. (another 53,000 students = $424 million)

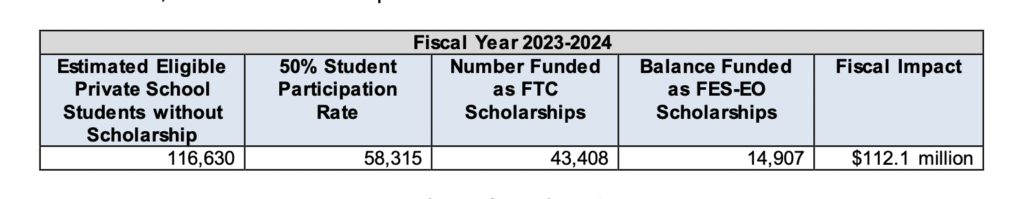

- The fiscal hides 43,408 in a tax credit scheme, pretending that diverting funds away from state coffers doesn’t affect fund balances ($347 million)

- Ignores this year’s 20,000 publicly funded homeschoolers by hiding them in the FTC. ($160 million)

- Ignores the impact of the staggered addition of 152,000 homeschoolers over then next 5 years, ignoring the costs of a possible 132,000 additional homeschool students to subsequent budgets. ($1.06 billion)

That adds up to over $2.3 billion… 2,000% higher than HB1’s fiscal analysis’ estimate of $112.1 million.

So far, committee discussions have all but ignored HB1/SB202 impact on:

- FES’s impact on FEFP State Aid, which is diverted away from school districts.

- The budgetary realities when a child leaves a school mid year and the money follows the child but expenses do not and fixed costs remain.

- The significant costs associated with addressing the significant learning losses seen in voucher students then they return to public schools.

Pro-voucher GOP lawmakers (which is essentially all of them) bristle at the suggestion that Florida has been defunding its public school. They pound the table and insist they have repeatedly passed budgets with “record education funding.” Though this may be true in raw numbers, it, too, is factually incorrect.

- Last year, fanfare accompanied the signing of what Governor DeSantis called his “Freedom First” budget. The budget totaled $109.9 billion, an 8.2% increase ($8.3 billion) over the previous year. Per pupil funding through the FEFP increased $385, an increase of 4.96%, significantly less than the total budget’s 8.2% increase. When Florida was flush with revenue, investments went elsewhere.

- Florida’s Base Student Allocation and Total Funds/student (TF/UFTE) have not kept pace with inflation for more than 2 decades (see below).

- After the high water mark of education funding during Governor Crist’s 2007/08 budget, Governor Scott’s massive budget cuts during the Great Recession, slashed Florida’s education funding. Correcting for inflation, education funding in Florida has never recovered. (see below)

- Florida repeatedly underfunds public education relatively despite adequate provision being the paramount duty of the state (Article IX Florida Constitution). Since 2008, our legislature has been focused on expanding vouchers/privatization, not adequately funding our public schools.

-

From fiscal year 2008-2019, Florida increased its spending on its voucher programs by 313%. During that same time period, Florida decreased its per-pupil funding for public education by 12%, from $9799 in fiscal 2008 to $8,628 in fiscal 2019. The other 49 states, on average, increased per-pupil spending during the same time period by 9.6%. During the same time, Florida experienced a 3.4% annual growth in GDP, outpacing the 3.1% mean annual growth for the other 49 states.

-

“Educational Effort,” the portion of Florida’s gross domestic product (GDP) allocated to funding PK-12 public education in Florida, decreased significantly during this time, despite public school enrollment increasing 6.8% over the same period. “In fiscal year 2008, Florida allocated 3.8% of its GDP to PK-12 funding, ranking it 18th among the 50 states. By fiscal year 2019, despite the increased enrollment, Florida was only allocating 2.5% of its GDP to PK-12 funding, conferring a rank of 48th among the 50 states.”

-

Florida’s GOP may campaign on “record education spending” but “Math” says otherwise. It is intellectually bankrupt to ignore the effects of population growth, inflation on public school funding and previous budget cuts on public education funding.

Here is a comparison of the 1st Calculations of the FEFP in 2007/08 and 2022/23. The 2007/08 dollars are inflation corrected using www.usinflationcalculator.com.

2007/08 (before Governor Scott’s massive – $1.3 Billion – education cuts):

Unweighted Full Time Equivalent/UFTE/student population: 2,642,323

Base Student Allocation: $4,164 ($6008 in 2023 dollars)

Total Funds/student or TF/UFTE: $7,306 ($10,542 in 2023 dollars)

Unweighted Full Time Equivalent/UFTE/student population: 2,983,465 (341,142 more student than 2007/08, a 12.9% increase)

Base Student Allocation: $4,587 ($1,421 less than 2007/08 in 2023 dollars)

Total Funds/student or TF/UFTE: $8,143 ($2,399 less than 2007/08 in 2023) dollars)

Simple Math:

The Total Funds needed to fund Florida’s current student population at 2007/08 inflation corrected dollars:

2,983,465 students x $10,542 (2007/08 inflation adjusted TF/FTE)= $31.45 Billion

Current FEFP is funded at $24.3 Billion.

The difference is almost 7 billion more than current FEFP funding levels! Florida’s funding has not kept up with inflation despite campaign slogans. HB1/SB202 will further divert funds away from our schools.

I believe it is intellectually bankrupt to ignore the current impact of these voucher programs on public schools and it is intellectually bankrupt to deny Florida has been defunding its public schools. The supermajority in the Florida Legislature needs own the fact that they have continued to relatively defund our public schools for more than a decade and they should embrace the harm that their privatization agenda has and will have on our schools. Anything else is intellectually bankrupt.